Latest Version

1.2.10

June 30, 2025

Databank LLC

Finance

Android

0

Free

mn.databank.merchant_super_app

Report a Problem

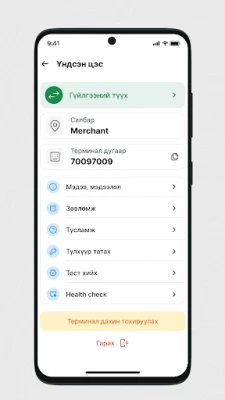

More About DiGiPOS Khan Bank APK Download for android

When Tech Shows Up in a Barbershop, Even If You Didn't Invite It

H2: It Started With a Client and a Phone Tap

So here’s what happened. Couple months ago, guy walks into my shop—one of my regulars. Quiet dude. Wears the same puffy jacket even in spring. We finish up his cut, and he goes, “Can I pay with DiGiPOS?”

I’m like, huh?

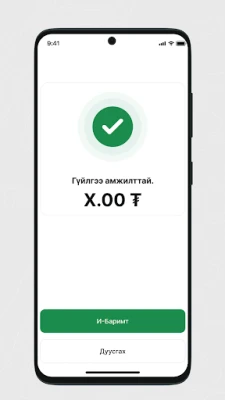

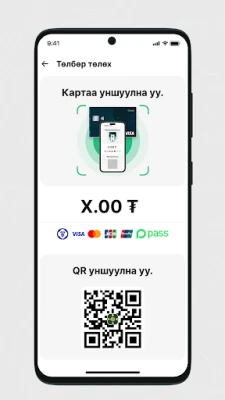

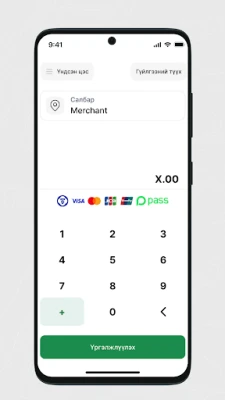

He taps his phone on this little machine he pulled from his coat like it was a magic trick. Few seconds later—ding—money in my account. Straight from his Khan Bank app, through something called DiGiPOS Khan Bank. No cash. No card. Just a phone and a flash of light.

H3: I Was Skeptical, Not Gonna Lie

I’m old school. My register’s been the same since the shop opened. Same till drawer, same stash of 100s folded under the mat for emergencies. So you can imagine, this phone-zap-money-transfer thing sounded like black magic. Or worse—like one of those things that sounds slick, then glitches when you actually need it to work.

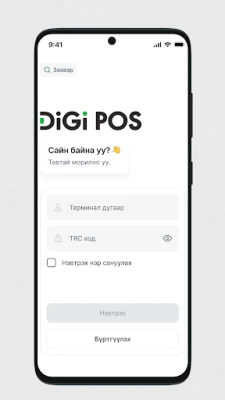

But the dude showed me how it worked. Looked clean. No extra app. Just inside his bank app. Said it’s part of this newer push Khan Bank’s doing with small businesses. This DiGiPOS thing lets folks like me accept payments without setting up full-on card terminals. Sounded almost too convenient.

H2: Next Thing You Know, I’m Signing Up

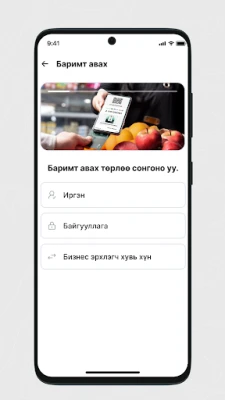

Couple days later, I had a line of regulars all telling me, “Bro, get on that DiGiPOS thing. It’s fast.” One even showed me how to set it up. Just need a Khan Bank business account (I already had one from years ago) and then you apply for the digital POS. They send a QR or a small NFC device, depending on what you’re into.

No big setup. No machines with rolls of paper receipts. I didn’t even need to plug anything in. Which is great ‘cause the shop already has one too many wires hanging around.

Now I just keep the little tag on my mirror. Client scans it, approves the amount, done. Kinda wild how quickly that became normal.

H3: Barbers and Banks—Not Exactly a Love Story

Let me be real for a sec. Most barbers don’t mess with banks more than they have to. We deal in cash, maybe a few transfers here and there. But these new banking services, the ones built with small businesses in mind—those are starting to make sense. Still, you gotta earn our trust. Can’t just walk in here talking about "frictionless payments" like we don’t have better things to worry about.

But DiGiPOS Khan Bank doesn’t feel like one of those half-baked fintech ideas. It’s actually working. Fast. Clean. No weird fees so far. And more importantly—it doesn’t slow down the shop. That’s key. I don’t have time to babysit tech while lining someone up.

H2: Clients Love It More Than I Do

Some of my younger clients? They’re all over it. Don’t even ask “Can I pay with DiGiPOS?” anymore. They just scan the code while checking their fade in the mirror. Feels natural for them. For me? I still double check the transaction went through before I give them the “All good, boss” nod.

Older folks, though? Different story. Still bringing crumpled bills and coins like it’s 2003. But I get it. Everyone has their own comfort zone. I’m just glad now I’ve got options that don’t involve digging around for exact change.

H4: The Tech Doesn’t Have to Be Flashy

I think that’s why this worked. It didn’t show up with flashy ads or buzzwords. Just... it worked. Quietly. Like a solid pair of clippers. No need to explain it every time or reboot it twice a day. That’s what small shop owners like me need. No distractions, no added steps. Just a way to take payments that doesn’t mess up the rhythm.

And I still take cash. Don’t get it twisted. But when someone forgets their wallet or just prefers tapping their phone? No problem anymore.

Rate the App

User Reviews

Popular Apps

Editor's Choice